Nigeria PAYE Tax Calculator

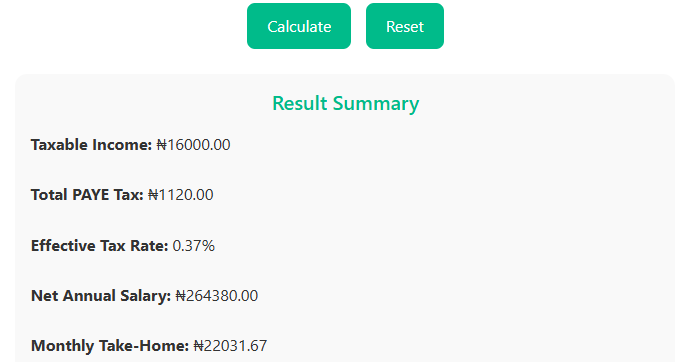

Result Summary

Taxable Income: ₦-

Total PAYE Tax: ₦-

Effective Tax Rate: -%

Net Annual Salary: ₦-

Monthly Take-Home: ₦-

Understanding taxes in Nigeria can be quite a challenge, particularly with evolving laws and regulations. But staying tax compliant is critical for both individuals and businesses, to avoid penalties and to plan financial decisions effectively. With the Finance Act 2023 in full effect, 2025 brings new tax processes, including changes in NHF calculations and statutory obligations under the Personal Income Tax Act (PITA).

Enter our Free Nigeria Tax Calculator 2025, your ultimate solution for stress-free tax calculations that adhere to the country’s latest regulations.

Overview of the Nigerian Tax System in 2025

Understanding the tax structure

Nigeria operates a graduated tax system where higher income earners pay a larger percentage of their earnings. Taxable incomes are categorized into bands, with rates ranging from 7% to 24%. Key statutory deductions include National Housing Fund (NHF) at 2.5% of gross income (effective with the Finance Act 2023), pension contributions, and health insurance deductions.

Key changes in 2025

Two major updates shape the 2025 tax scene:

- NHF Calculation Shift: NHF is now calculated as 2.5% of gross income, rather than basic salary.

- Minimum Wage Compliance: With the national minimum wage set at ₦70,000, those earning this amount or less are exempt from PAYE tax.

Importance of Understanding Tax Obligations

For employees, accurate PAYE deductions ensure compliance while preventing overpayment. For employers, staying updated with tax changes safeguards timely remittances and compliance with regulations, avoiding penalties from tax authorities like FIRS.

Key Tax Laws and Amendments Shaping 2025

Personal Income Tax Act (PITA)

The PITA remains the foundation of income tax calculations, outlining the tax rates applicable to various income bands. It also incorporates allowances such as consolidated relief.

Finance Act 2023 Implications

The Finance Act introduced significant updates, including:

- NHF now applies to gross income.

- Minimum wage earners (₦70,000 or less) are exempt from PAYE tax.

These changes enhance transparency and equity in tax deductions while simplifying compliance for employers.

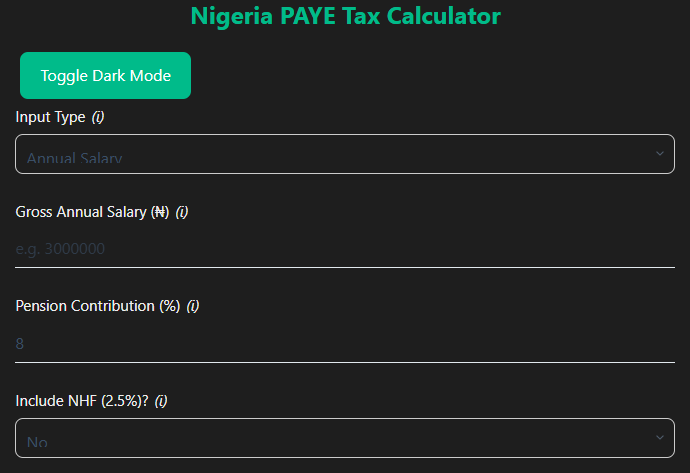

Understanding Our Free Nigeria Tax Calculator 2025

Our tax calculator is designed to make tax compliance seamless for Nigerian employees and employers. It caters to the latest tax laws, ensuring 100% compliance while delivering accurate and easy-to-understand results.

How the Tax Calculator Works

The calculator considers:

- Current Nigerian Tax Laws: Including PITA and the Finance Act (2023).

- Statutory Contributions: Incorporating pension and NHF.

- Relief Allowances: Accounting for consolidated relief to ensure accuracy.

- Salary Parameters: Catering to all income levels, including minimum wage earners.

Key Features

- Real-Time Accuracy: Fully compliant with the Finance Act, calculating NHF on gross income.

- User-Friendly Interface: Simple and intuitive, accessible across all devices.

- Transparent Breakdown: Clarifies PAYE, NHF, and pensions.

- Adaptable for Scenarios: Handles multiple income brackets and customized inputs.

Step-by-Step Guide to Using the Tax Calculator

- Enter Salary Details: Input monthly or annual gross income.

- Provide Allowance Information: Add housing, transport, and other allowances.

- Statutory Contributions: Input pension and NHF amounts.

- Calculate Results: Receive a detailed summary, including taxable income, PAYE tax, and net pay.

- Adjust for Scenarios: Try different income cases to understand tax variations.

Calculating PAYE Tax Made Simple

PAYE Explained

Pay-As-You-Earn (PAYE) is a system where employers deduct income tax directly from salaries. It is calculated progressively, meaning higher earners pay a higher percentage.

Impact of the New Minimum Wage

Under the Finance Act, employees earning ₦70,000 or less pay no PAYE tax. For others, the tax rates are applied based on graduated income bands starting at 7%.

Statutory Contributions and Reliefs

Pension and NHF Contributions

- Pension: 8% of basic salary, housing, and transport allowance.

- NHF: 2.5% of gross income under the Finance Act 2023.

Relief Allowances

Relief allowances like consolidated allowance reduce taxable income, ensuring individuals retain more of their earnings.

Real-World Examples

Example 1: Entry-Level Employee

- Monthly Gross Income: ₦70,000

- NHF Contribution: ₦1,750

- PAYE Tax: ₦0

- Net Pay: ₦68,250

Example 2: Mid-Level Professional

- Monthly Gross Income: ₦150,000

- Contributions: NHF at ₦3,750 and pension at ₦12,000.

- PAYE Tax: ₦18,952

- Net Pay: ₦115,298

Example 3: Employer Costs

For an employee earning ₦150,000, the employer contributes an added ₦18,000 for pensions.

Example 4: The Finance Act Impact

For a gross income of ₦200,000, NHF shifted from ₦5,000 (on basic salary) to ₦5,000 (on gross), ensuring correct deductions.

Take Control of Your Taxes Today

Mastering taxes is no longer a daunting task. With our Tax Calculator, you gain clarity, compliance, and confidence. Simplify your tax calculations and focus on what matters most.